|

| Europe - BEFORE the crisis! |

Greetings

Friday, 2 December 2011

The Final Countdown; or The dumbness of number quoting and the end of the occident

Labels: Pay, Rockstars, Banksters, Incredulity

Counting Stuff,

Stupidity,

Unexpected outcomes

Friday, 11 November 2011

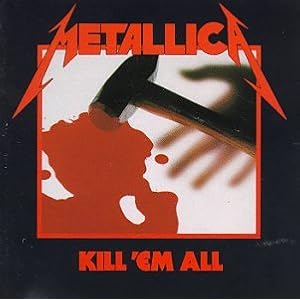

The Eye of the Beholder - RnRF-Reviews: Lulu

|

| No, it doesn't get less depressing. |

Talking of anxiety: I had been anticipating the arrival of 'Lulu' with a barely contained sense of dread since from when I first learned about the collaboration effort between the (by now slightly ageing) gods of thunder and the (yet even older) undisputed king of sexually inspired misery poetry. What good could possibly come of that? I wasn't heartened after the first bunch of reviews. At best there seemed to be a sense of confusion and incredulity mounting in the open minded. Outright disbelief and scorn from traditionalists on both side of the marriage. And howls of incomprehension from the rest. Not exactly a good sign.

|

| All in all, somewhat unexpected. |

So would this discerning critic recommend it to you? Not if you are looking to stuff something entertaining onto your iPod. To be honest, this is probably best listened to at home, on your own, when you are sufficiently misanthropic to start with. And bear in mind that I actually wanted to like this. I'm sure you can find plenty of reasons to find this underwhelming. But if you are ready to accept that jaded millionaire rockstars can sometime actually strike gold in their (often misguided) search for a new experience, rather than turn into Iron Maiden / a circus act, then this might actually work for you. Just don't expect to feel chipper afterwards.

Labels: Pay, Rockstars, Banksters, Incredulity

Peformance Reviews,

Pimpage,

Rockstars,

Unexpected outcomes

My Childish Pleasure: Milestones, Satan and big(ish) numbers!

Woe to you Oh Earth and Sea

for the Devil sends the beast with wrath

because he knows the time is short

for the Devil sends the beast with wrath

because he knows the time is short

Let him who have understanding

reckon the number of the beast

for it is a human number

its number is six hundred and sixty six.

its number is six hundred and sixty six.

|

| A pretty pathetic reader count...but it still made my day! |

Labels: Pay, Rockstars, Banksters, Incredulity

Counting Stuff,

Self indulgence

Thursday, 3 November 2011

Raining Blood - Greece, Mercs, Merkel and the EFSF

Raining blood

From a lacerated sky

Bleeding its horror

Feeding my structure

Now I shall reign in blood!

- Raining Blood by Slayer -

|

| "One more referendum and I will fuck him up." |

Today

something vaguely frightening/flattering happened: the inimitable, esteemed and often unflappable

blogger and keen observer to the human condition RogerofSicily dared me to

explain or - even worse - make sense of the Kabuki theater that is the European

effort to bail out Greece. It’s not exactly like he’s asking me to unify

quantum physics and Einstein’s view of the world but it still made me kind of

gulp with trepidation. But then again, this is Rock’n’RollFinance! So there,

here we go: Challenge accepted! ...Don’t blame me if this gets boring half way

through!

Rather than go straight to the “why bother?” part of the bail-out question, it might be worthwhile to

start with the “how did we end up in this mess?” end. To brighten things up

I’ll be channeling a bit of Teutonic working class heroism in an effort to

bring us closer to comprehension. I’ll be drawing heavily on the efforts of

Superfritz. Hope you don’t mind, but do consider yourself referenced!

So let’s step away from the global super-macro perspective and have a look at the German micro perspective to understand why this is (politically) not exactly straightforward. The story goes as follows:

German worker goes to work and builds a great Mercedes.

German worker gets paid 2,500 Euros, pays 1,000 Euros taxes/social security and saves 250 Euros on his savings account at stupid German bank, because he wants to buy a great Mercedes sometime in the future.

Stupid German bank takes the 250 Euros and buys some funny paper from a stupid US bank for 100 Euros and some more funny papers from US government for 100 Euros, converted into 100 Dollars. For good measure it also buys some 50 Euros of funny paper from the Greek government.

The stupid US bank is happy. It found someone even more stupid to buy its mortgage risks.

US government is happy. It has a handful of wars to run and taxes to break. Wars and tax breaks are expensive.

German worker goes to work and builds a great Mercedes.

German worker gets paid 2,500 Euros, pays 1,000 Euros taxes/social security and saves 250 Euros on his savings account at stupid German bank, because he wants to buy a great Mercedes sometime in the future.

Stupid German bank takes the 250 Euros and buys some funny paper from a stupid US bank for 100 Euros and some more funny papers from US government for 100 Euros, converted into 100 Dollars. For good measure it also buys some 50 Euros of funny paper from the Greek government.

The stupid US bank is happy. It found someone even more stupid to buy its mortgage risks.

US government is happy. It has a handful of wars to run and taxes to break. Wars and tax breaks are expensive.

Greek government is happy. It has a legion of civil service unions to buy off and needs to keep up with the neighbours in the “buying-Bundeswehr-surplus-tanks” competition. Doesn’t have to bother with tax collection either now!

Stupid US bank pays huge bonus to banker who sold funny paper. Stupid German bank pays huge bonus to banker who bought funny paper.

Stupid US bank takes the 100 Euros and grants another mortgage to US IT consultant.

US IT consultant takes out mortgage, uses the money (incl. the 100 Euros saved by the German worker) to buy himself a great Mercedes for 100,000 Euros. Why wait and save to buy it? That's so 1950s! US IT consultant is happy. His house has turned him into millionaire. He drives a great Mercedes.

Mercedes is happy. It now has money to pay 2,500 Euro to the German worker, 10,000 to the German government and 87,500 Euros to its shareholders in Kuwait.

Kuwait shareholders are happy.

German government takes 10,000 Euros, pays 5,000 to pensioners and unemployed, 1,000 to Eastern Germany, 3,000 for "other expenses" and 1,000 Euros for non-existent olive trees in Greece and great Spanish Autobahns.

Kuwait shareholders are happy.

German government takes 10,000 Euros, pays 5,000 to pensioners and unemployed, 1,000 to Eastern Germany, 3,000 for "other expenses" and 1,000 Euros for non-existent olive trees in Greece and great Spanish Autobahns.

Greek farmer is happy. Considers buying a Mercedes. Spanish construction worker is happy. Considers buying a Mercedes. German worker doesn't really understand what's going on. Goes to work to build Mercedes.

|

| Scene at the Eurozone bail-out summit |

Restart at top. Repeat 10 times.

= Trade imbalance.

Turns out, US IT consultants house is worth half his mortgage. US IT consultant gives house and car keys back to bank. Pity. But what a great time he had with his great Mercedes!

Stupid US bank goes bankrupt.

Stupid German bank reads the funny paper it bought from stupid US bank for the first time (500 pages in English, hello?) and finds out it's bankrupt, too.

German government uses taxes of German worker to bail out stupid German bank's shareholders. German worker's kids Kindergarten is not refurbished. No money left. But German worker still has savings of 250 Euros at state owned stupid German bank. Phew!

Stupid US bank is bailed out by US state, using the 100 Euros saved by German worker given to it by stupid German bank.

US government is broke. Invents new term for inflating debt away. "Quantitative easing”, sounds funny. German worker doesn't get it.

US government returns 100 USD to stupid German bank. Bank converts 100 USD into 10 EUR. Ooops, 90 Euros gone. Stupid German bank is bankrupt again.

German government uses German workers taxes to bail out stupid German bank again. German worker's street is not repaired. No money left. But German worker still has savings of 250 Euros at state owned stupid German bank. Phew!

German government uses German workers taxes to bail out stupid German bank again. German worker's street is not repaired. No money left. But German worker still has savings of 250 Euros at state owned stupid German bank. Phew!

German bank now no longer keen on buying funny Greek government paper. Stops that non-sense.

Greek government figures out it is broke too. Didn’t bother with tax collection. Why bother when stupid German bank gives you money?

Enter ECB.

ECB council decides that sticking to rules is for stupid Germans. Easier without rules. Much more fun. Cranky Germans don't get the joke. Typical. ECB buys lots of Italian and Greek debt at knock-down price.

THE FUTURE:

ECB decides that 2% inflation is too ambitious. The rules are only paper, after all. ECB decides 10% inflation is better for majority of countries in ECB council. Cranky German still doesn't get the joke. Ah, these Germans...

German worker goes to bank. Wants to buy Mercedes with money saved. Bank gives him 250 EUR back. Plus interest. German worker is happy.

German worker goes to buy Mercedes. Turns out, Mercedes now costs 123,890,571,238,457 Euros, instead of 100,000 Euros. German worker uses savings to buy himself a glass of Schnaps instead. German worker is a bit cranky. Now understands what "Quantitative Easing" means. Doesn't get the joke. Lack of humour, presumably.

US banker: got huge bonus

German banker: got huge bonus

US IT Consultant: got Mercedes and huge house (for a while)

Mercedes shareholder: got dividend

Greek farmer: got subsidies

Spanish construction worker: got subsidies

Bond holders: got bailed out.

German worker: got bill.

German worker feels so 1950s. Needs to catch up with rest of world. Should have borrowed money years ago to buy Mercedes. Honest work and sticking to rules makes no sense. Quantitative Easing makes alles kaputt.

Greek and British papers tell German workers it's all his fault because his granddad invaded Poland.

Merkel after the post summit press-conference

I'm not even going to try explain how the EFSF is supposed to work in all this. I'll need to drink a lot more to try that.

Labels: Pay, Rockstars, Banksters, Incredulity

Apocryphal Writings,

Being Evil,

Demented Stuff,

Rioting/Muppets,

Rockstars

Sunday, 16 October 2011

1%ers - Public Enemy Number One! Or maybe just your doctor.

|

| 1%ers - Strangely not including dope smoking bikers |

Mind you, maybe these upstanding folks with the ethnically diverse musical tastes and questionable hairstyles are not just objecting to finance professionals to be in the top one percent of the money making fraternity, maybe they object to the very notion that anybody should be in the one percent bracket. Last I checked, however, getting rid of the top one percent of any distribution only really works if you flatten the whole thing out more or less completely. Last anybody tried that everybody ended up wearing rather dreary boiler suits and would've made George Orwell both proud and distinctly uneasy. Oh, and they gave it up when they figures it didn't really solve their issues. Go figure, China. Anyway, looks like ideologues have all the answers and as such they don't need to care too much about arguments. Or as Billy boy was putting it: they don't need to care about how the opposition is doing. Almost makes me wonder why I am. Before I leave you to meditate on it all, just remember, true 1%ers do not wear pinstripes. They look a bit like this:

|

| Grade A Banker |

Labels: Pay, Rockstars, Banksters, Incredulity

Incredulity,

Pay,

Rioting/Muppets

Wednesday, 21 September 2011

Katy Perry, pink latex, death metal and Gordon Brown

I was going to write something about Gordon Brown topping out the league of the world's most devastating rogue traders but then I got side tracked. Sorry! I hope this is suitably weird recompense.

Labels: Pay, Rockstars, Banksters, Incredulity

Demented Stuff,

Rockstars

Tuesday, 20 September 2011

Gunfire, nazis, randomness, statistical analysis and a mediocre Iron Maiden song

Apologies, linking up somebody else's nifty work hardly qualifies as a post, but I'm just too knackered for a proper rant today. At any rate, I love this piece. If you ever thought statistical analysis was irredeemably boring, this should change your mind. Or maybe not.

And here's a picture of Eddy...can't believe it's taken me until now to get one up!

And here's a picture of Eddy...can't believe it's taken me until now to get one up!

Labels: Pay, Rockstars, Banksters, Incredulity

Being Clever,

Demented Stuff,

Pimpage,

Unexpected outcomes

Sunday, 11 September 2011

Goldman Sachs doing God's work. Or something like it.

This is just so deliciously fucked up, I don't have any further comment.

Labels: Pay, Rockstars, Banksters, Incredulity

Demented Stuff,

Rockstars

Drain you of your sanity; face the thing that should not be! – On the retardedness of the inverted CDS curve

|

| Restating your PnL? WTF!!! |

We all know (or should

know by now) that when the revolution finally comes all manner of folks will be

put against the wall. Now, the big fear I have is that no one is going to

ensure that risk managers are rounded up and get their dose of revolutionary

fervor. The problem is that it’s just that is an occupation so obscure that the

average neo-communist revolutionary / not-so crypto idiot with an AK-47 will

simply fail to spot what reactionary fiends of the night / capitalist

technocrat lackeys risk managers really are.

But why the special

attention to risk managers I hear you ask? What makes them so deserving of

revolutionary wrath? Well, basically because they don’t really do their job!

The point of a risk managers’ existence is ostensibly to ensure that a bank’s

risk book is run within parameters that ensure the risk reward ratio is

acceptable and that book is actually valued sensibly in accordance with a

pricing policy. And that’s exactly what I’m going to moan about today. The fun

and games that kept all manner of financial type and politicians awake over the

last couple of weeks have given ample illustration that these risk books are

still very much marked not to some rational or even just explicable standard

but basically marked to some make believe figures that ensure we all get paid

at the end of the year.

The proof? Enter the

retardedness that is the inverted CDS curve. Basically, in financial market

parlance an inverted CDS curve is taken to be a reasonably sure-fire sign that

a financial entity (i.e. the one the CDS in question relates to) is in DIRE

TROUBLE and likely to IMPLODE. Why? What does that all mean? Well, a CDS curve

consists of a series of points (spreads) that express the expected default risk

of a financial entity between now and a future point in time. In more orderly

times a CDS curve is upward sloping, that is the spreads (and with it the

implied likelihood of default) increase the further your time horizon reaches

into the future. Which kind of makes sense. All things being equal the second

law of thermodynamics (among a few other things) would indicate that the longer

something goes on the more likely things are to fall apart. So what happens

when markets are in distress? The reality is that when sentiment turns against

somebody (like the US Government during the unspeakably childish debt ceiling

squabble in Washington DC) you’ll find it hard to execute trades with longer dated

maturities. People simply don’t want to take on the risk of longer maturities.

At the same time the nearer dated maturities (that you still can get a

quote for) will command a higher risk premium, so the spreads will rise. Now,

by convention the maturities for which you can’t get a new price will be simply

be staled (carried forward from whenever you last got a quote for them) while

the shorter maturities for which you still can get a quote will rise. So what

can happen in this particular scenario is that you can get an ‘inverted’ CDS

curve, where the nearer dated maturities have a likelihood of default that is

higher than the further dated ones. Fair enough you say? You might think so;

after all it would look like you are making use of the most recent data that

you have to build that curve. So what’s the harm? The harm is that those curves

are used to price existing CDS transactions on banks’ books and that’s just

plain retarded. Think about it: the risk of a default occurring between now and

a future date as expressed by a CDS spread is a non-Bayesian event. The

timeline observed for the determination of a credit event (default) is

continuous and once the event occurs it will trigger ALL Credit Default Swaps

that are referencing this particular reference entity. So there is something

deeply and disturbingly wrong with a situation where you have a curve that

would imply that the one-year default risk of a company is lower than the five-year

default risk of the same company. While I agree that this topic has distinct

overtones of needless sophistry / intellectual masturbation about it, it

actually is a pretty good indication of what is wrong with modern finance. It’s

a bit like that early morning nose-bleed so prevalent among punk bankers and

almost-made-it rock stars; not exactly shocking in its on right but clearly

indicative of a big old problem. Something is indeed rotten.

|

| James Hetfield totally rocks! |

So, to come back to my

point about why risk managers need to be brought to the front of the queue when

the masses rise up against the system: What does that have to do with inverted

CDS curves? It’s simple, it’s those guys that are using just those curves to

value the credit books, thus plainly misstating the true value of said book (or

lack thereof!). Strangely enough there is zero outcry over such egregious use

of sleight of hand accounting to give the illusion of greater stability in the

financial system than there really is. I doubt that is because the issue is too

difficult to grasp. It really isn’t. But it is sufficiently obscure to be swept

under the carpet. It’s not exactly something Robert Peston will be able to

blitz the BBC Newsnight viewers with in a 90 second sound bite designed to

excoriate bankers and whip incredulous middle-class viewers into a frenzy of

polite incredulity. In a nutshell, if your job is to manage risk, you probably

shouldn’t be in the business of downplaying the volatility of a risk book. But then

again that’s probably saying more about the way incentive compensation is

calculated than what is truly sane. Never mind. Move on, nothing to see here. Go back to shopping for some Apple products.

Labels: Pay, Rockstars, Banksters, Incredulity

Apocryphal Writings,

Being Evil,

Obscurity,

Stupidity

Sunday, 28 August 2011

Mandatory Suicide

Right, in a shamelessly transparent attempt at courting controversy (or at least increase traffic a little) I have changed the comment settings for RocknRollFinance so now everybody can comment, even anonymously. Obviously, I have now crossed the Rubicon of publicity prostitution and am at the mercy of every degenerate internet troll, anti defamation league vigilante or socialist youth activist. But it sounds like it'd be more fun that way.

PS: the picture of a youthful Blackie Lawless is just for kicks.

PS: the picture of a youthful Blackie Lawless is just for kicks.

Labels: Pay, Rockstars, Banksters, Incredulity

Self indulgence

The fifth horseman of the apocalypse; or why it'll probably pay to be on the side of the Antichrist this time round.

"The Horsemen are drawing nearer

On the leather steeds they ride

They have come to take your life

On through the dead of night

With the four Horsemen ride

or choose your fate and die"

Inflation is spooking the chattering classes! With every quarterly revision (upward, naturally) of the BoE (or ECB or Fed et cetera) inflation figures on the evening news bulletins hard working, mortgage paying, middle class wage slaves all over the ever declining and decaying western world squint a little harder at their TV sets, gnash their teeth a bit and clench their buttocks in anticipation of yet another incremental reduction of their spending power. Why, oh, why - you can practically hear them complain - is there no one doing anything about the steady erosion of our purchasing power? Why does purple sprouting broccoli cost so much more than last year? Why does no one do anything about all those foreign folks (Asians, mostly! - just savour the barely suppressed xenophobia before you move on) driving up prime real estate prices in central London? Why can I no longer afford to fuel up my over-featured and over-motorised SUV every other day with the careless swagger and pay those public school fees?

Well, I guess the answer to these question is that while it sucks to be made poorer through inflationary pressures, it is a (a) whole lot less painful than being made poorer through deflationary pressures (at least as long as that inflation rate stays vaguely in control - but more about that later) and (b) this might actually be a policy in your favour. How come? Our peerless political and economical leaders obviously have almost zero incentive to spell this out plainly (they _do_ want to be re-elected, by and large), but this debate is not really about whether making most of us poorer is something that needs to happen, but how they go about engineering this. The point being that as political, public and private entities in the majority of countries of what is commonly termed the West is so terminally over indebted that there is really no credible way to avoid some form of wealth adjustment. If you don't think so, then don't worry, reality is entirely optional given the right mix of sedatives.

One of the great benefits of living on the middle class reservation that is the EU/US/Japan megaplex is that we get to chose what currency we denominate the debt that we have taken on to pay for all those flatscreen TVs and iPads. The poor suckers that have accepted our IOUs (I.e. The hapless sovereign wealth fund managers of the People's Republic of Hypocrisy who have bought our sovereign debt) didn't get to chose. They had to make do with a selection of USD/EUR/GBP/JPY denominated paper. Now until fairly recently they didn't worry too much about that as they were never interested in letting their own currency float on the international exchange markets, after all they do want to indefinitely maintain their low cost base as a primary competitive advantage (otherwise they might have to - gasp! - in cease competitiveness through innovation). But as it turns out, fixing your exchange rate against your primary export markets ceases to be an unequivocally smart move when you end up being a significant creditor in such a currency and the debt issuer decides to debase their funky fiat currency. In fact you'll get hit twice! So, when chairsatans Bernanke and Trichet turn open the spigots of monetary policy and fix interest rates at historic lows not just for now but even for years to come your precious surplus Dollars/Euros/whatevers become worth less and less to you. In effect the creditor nation gives a subsequent discount to the goods previously exported to the debtor nations. Annoying,no doubt. However, the real kicker comes not from the depreciation of your assets (those precious sovereign debt bonds), but through the import of inflation through the back door. Sadly, for our Chinese friends, not only are the sovereign debt markets dominated by a handful of currencies that are not their own, also a lot of the world's trade in commodities is. Which is a bummer if you are a manufactured goods exporting creditor nation. Low USD or EUR interest rates will lead to increased inflation not only in developed (and over indebted) nations but also in commodity markets. And that means imported inflationary pressure back in mainland China. So, if you are on the CCP's central committee you now are facing Hobson's choice: abandon the anchor your currency (crawling, if you want to be finicky) peg and let the RMB appreciate (and thus limit the inflationary pressure through imported commodities while at the same time making your export industries less competitive) or stick with it and watch food and energy prices go through the roof.

You see, the big unspoken about inflation is not that it sucks for all, but that it sucks a lot harder if you are poorer. And that's where this is all beginning to make sense. Joe Bloggs in Sampletown USA will whine about gas costing him 5 bucks a gallon. But if he is _really_ under pressure and still needs to drive fro his daily commute he _can_ go and buy himself a flipping Fiat 500 instead of that Ford F150. Whatever the Chinese equivalent of Joe Bloggs in rural China is probably won't find that so easy. If you spend 90 percent of your income on food and fuel, then doubling the price of staples like say wheat actually is a bit more of an issue. Oh, and please spare me comments about how disaffected youth rioting in London shows that there is real poverty in the west too. Of course, there is. But it's pretty insignificant. The motivation behind rioting because you can't afford some Nike AirMax is not quite the same as when you riot because YOU ARE STARVING! some monetary policy, eyh?

Now, I understand that this is a pretty sweeping arc and it presupposes all sorts of machiavellian machinations and reptilian cold bloodedness on the part of the monetary policy committees of the western world, to a degree that makes the Rothschilds look like amateurs and will make Ayn Rand devotees wet themselves with delight. And on the balance of probabilities whatever they come up with is more likely to be cock-up than conspiracy. But if I can thin like that, I should imagine, so can they. Am just saying...

Off to the pool now!

Labels: Pay, Rockstars, Banksters, Incredulity

Apocryphal Writings,

Being Evil

Friday, 12 August 2011

Dumb, dumber, short selling ban

Consider the following: Brazil and Azerbaijan are playing a world cup match. Half-way through the second period (apologies for the Americanism, I’m trying to avoid repeating “half”) Brazil is up 3-nil. So far, so ordinary. Sepp Blatter, however, has big plans for expanding FIFAs footprint in Asia and desperately needs to increase the attractiveness of the beautiful game to the descendants of Ghengis Khan so he can make even more money in bribes. Ergo, the rules of the game get changed and from the 70th minute onwards Brazil is disallowed a goalie. Miraculously Azerbaijan overcomes all the odds and secures a stunning victory over Brazil after 90 minutes of play. Does that sound like a reasonable story? If yes, then you don’t need to bother continue reading. If, however, you think there’s something rotten in the twisted logic that informed the sudden rule-change then I suggest you turn your attention to the latest act of dirigisme lunacy put in place today.

Consider the following: Brazil and Azerbaijan are playing a world cup match. Half-way through the second period (apologies for the Americanism, I’m trying to avoid repeating “half”) Brazil is up 3-nil. So far, so ordinary. Sepp Blatter, however, has big plans for expanding FIFAs footprint in Asia and desperately needs to increase the attractiveness of the beautiful game to the descendants of Ghengis Khan so he can make even more money in bribes. Ergo, the rules of the game get changed and from the 70th minute onwards Brazil is disallowed a goalie. Miraculously Azerbaijan overcomes all the odds and secures a stunning victory over Brazil after 90 minutes of play. Does that sound like a reasonable story? If yes, then you don’t need to bother continue reading. If, however, you think there’s something rotten in the twisted logic that informed the sudden rule-change then I suggest you turn your attention to the latest act of dirigisme lunacy put in place today.

Sure, a selective short selling ban (focused on “systemically important” banking stock) in a number of European countries seems to have lessened the vigor with which markets eroded the share prices of said banks for the moment. It also demonstrates a comprehensive failure of regulatory bodies and lawmakers to comprehend what they are dealing with. As I might’ve pointed out previously, the whole point of a market is to determine the price of a particular asset given current circumstances as appraised by any number of participants in that market. Consequently, prices can move up as well as down. Not exactly an earthshattering realization one might think (google that phrase and you get approximately 20 million hits for that). Alas, it would appear that that’s not the plan of our betters. No one is allowed to take the view that certain banks are overloaded with toxic debt and are better jettisoned. Well, you are allowed to, but ONLY if you have previously bought them and are willing to crystalize a loss when you sell them for less than you previously bought them. Strangely enough, not a lot of pension fund managers want to do that. Realizing losses is a great way to get yourself fired or worse, forfeit your bonus! Those other who might have caught on to the fact that all is not well without making a stupid investment first are just not allowed to play. Basically the logic goes: if you are smarter than the others (or just willing to put your money on betting against the herd mentality) you are not welcome to play here. This market is for conformist idiots only! Obviously, this escaped the attention of just about everybody, seeing that until now that particular rule didn’t really exist. So far the football simile holds up. Sadly, for the regulators / Sepp Blatters of the financial world this is where the comparison runs out of steam. Why? Unlike a football game there’s not time limit on how long a game runs in the markets. You might be able to secure Azerbaijan’s win over Brazil by rigging the rules of the game because in the end Brazil will run out of time. In markets, however, each day is a re-match. Even if you get to rig the rules on a daily basis, at some point you (the rule rigging regulator, that is) will run out time. The point being that short sellers are not a problem in themselves, but rather a symptom of an underlying vulnerability in the assertion that current stock prices are not incorrectly reflecting the true value of a company. Yes, sure, think of them as the carrion bird of the financial world. But that’s exactly my point. They will come and pick at a carcass, but they are not the ones who will kill the damn cow in the first place! If the cow were healthy, they wouldn’t get to feast and they’d move on. Now, no one really wants the cow dead, but in the end there is no point pretending it’s still alive. But understanding that, clearly seems to be off the agenda for the time being.

Labels: Pay, Rockstars, Banksters, Incredulity

Apocryphal Writings,

Incredulity,

Obscurity,

Stupidity

Back in black!

I'm back! Well, sort of. I hope to be more regular going forward. Failing that, I'll just try to be not entirely absent. Feel free to doubt my commitment.

Labels: Pay, Rockstars, Banksters, Incredulity

Self indulgence

Tuesday, 7 June 2011

The sands of time...

Labels: Pay, Rockstars, Banksters, Incredulity

Self indulgence

Monday, 9 May 2011

Meditations on the law of unintended consequences (or why the invisible hand bitch slaps all of us)

Just two days ago came a across an appalling revelation. Speaking to my grad (yes, I have one of those quasi-slave / squire types called "graduate trainee" that is still hoping to one day become the next Gordon Gekko) about how the burrito assembly line at that was catering for our lunch was quite the modern day equivalent of Adam Smith's pin factory he (that is my grad) admitted to me that he had no idea who or what I was talking about. Even my gentle hinting that the profile of Adam Smith and an illustration of aforementioned pin factory are adorning current day 20-pound notes did not solicit a flicker of recognition. Now, don't get my wrong: I'm not writing this to berate said grad. He is clearly smart, bright eyed, ambitious, hard working and furnished with a curriculum vita that makes you quiver with dread when you read it. However, I would've thought that at least a cursory knowledge of Adam Smith and his book "An Inquiry into the Nature and Causes of the Wealth of Nations" might be expected from any aspiring banker. Apparently that is a vain hope, as I found out much to my dismay after a short straw poll around the office. As intellectually dissatisfying as this might seem, I wonder whether this might not serve to explain an awful lot about what is going on in the world of finance these days. You see, the single most crucial concept that Adam Smith introduces in his treaty (apart from explaining the benefits of the division of labour, using his pin factory example) is that of the invisible hand. Said hand being the self interest of people that guides them to individually produce or consume goods according to their best needs and capabilities and in turn communally determines the price for goods and services that are so produced and consumed. It is a quite truly revolutionary concept that not only challenged the notion of central authority in a meaningful way but also lies at the very heart of what we understand economic enterprise to be. It is nothing less than the foundation of the realization that complex systems are best not governed by the diktat of a central authority but through self-organization within the confines of a set of operating guidelines and rules that determine the parameters of acceptable behavior within such a system. The funny thing is, that I think there may be more to this than a woeful lack of erudition in matters relating to basic economic and behavioral theory on the part of some more or less junior banking employees. I can't help but wonder whether references to the invisible hand in the media or other forms of public (non-academic) discourse for the most part have not simply become a bit of an empty phrase. Part economic editorial iconography, part meme without any real understanding of the implicit meaning of the imagery employed. Come to think of it, I do wonder whether that lack of understanding is not an awful lot more pervasive among those who should know better than I dared imagine. Now, in the aftermath of various bouts of verbal and intellectual diarrhea by such rabid free market theory proponents such as Alan "I found a flaw in my ideology after I phuqued up your economy" Greespan you might consider it understandable that it has become terrible unfashionable to invoke forces of market to address matters of distribution. And I am inclined to agree that expecting certain markets to "self-regulate" and then expect them to produce socially acceptable outcomes is an reasonably retarded proposition. I think, however, the true problem here does not lie with the notion of using markets (or in Smith's parlance employ the guidance of the invisible hand) to find prices at which goods and services are most efficiently distributed. The problem lies in a total lack of understanding what this actually means. Markets are great price finding mechanisms. Not more, not less. And what they do is find a price given whatever set of rules and regulations governs the conduct on a given market. The trouble is that if you have a certain set of rules in place, this will tell you very little about what the market itself will make of those rules in regards to the outcome of the price finding process. It will only ensure that norms of behavior are met when a market is operating. Sadly, the moral conduct of individuals operating within a market environment (and its rules) is now often confused with validity of the outcome (i.e. the price finding process) of just such a market. The dichotomy of the individual and the communal, the tension of interests that manifest themselves as the guidance of the invisible hand seems to get lost when people talk about markets (and in that context ignore Adam Smith) these days. If we were clever enough to set market rules in such as way that we could dictate the outcome of a given market's pricing finding process we probably wouldn't have to rely on markets in the first place to do anything. We could just set a transaction price and expect that to be the efficient outcome. That is what is called central planning. I didn't work out so well in those parts of the world where they REALLY tried (anybody who now mentions moderns China as a counterpoint it beyond saving). You see, the problem is that generally speaking humans as individuals (or even worse, when they are on committees) are amazingly bad at dealing with non-linear lines of causation and multiple order effects. What we do when we set up markets we basically utilize a whole lot of individuals as computational nodes in a massive parallel processor. On its own each of these nodes is pretty unexciting but as a collective they manage to produce results in a rather more convincing and quicker manner. So far so good, I hear you say, but what does that have to do with Adam Smith? Well, what I fear, is that by losing sight of the underlying mechanisms that underpin markets of various stripes we are getting ourselves into a state where public debate about how to regulate said markets (i.e. set those rules and boundaries within which the magical price finding process is supposed to take place) becomes a pretty pointless exercise. The whole point of regulating markets effectively is to provide level playing fields for its participants, not to pre-determine the outcome of a markets operation. If you do try and set the rules to try and dictate some outcome that would appear politically expedient I guarantee you that while you might bask in warm glow of success at first, but there will be other consequences not anywhere near as desirable or indeed foreseen. Take a reasonably obscure subject: regulatory mandated over the counter derivatives central counter-party clearing. The ostensible aim of this (currently evolving) regulatory initiative is to make trading in bilaterally agreed financial derivatives transactions more transparent, eliminate the unchecked concentration of positional risk and limit the fall out of any potential collapse of a major financial institution a la Lehman Bros. Nothing terribly controversial here, I should imagine. But hold on, by introducing a variety of reporting and processing requirements, derivatives trading is going to become more expensive, in turn leading to a likely reduction in participants and volumes transacted in this type of market. Well, you might be right in surmising that it might well be the objective of the legislative bodies discussing this kind of rules to do just that. After all, Warren Buffet described derivatives or weapons of financial mass destruction and they were very much instrumental in tripping up the not-so-clever-after-all masters of the universe at Lehmans, Bear Stearns, Northern Rock and practically all of Iceland and a whole bag of assorted financial institutions who most of us have never heard of. So wouldn't make trading these things more difficult a good thing? Alas, odds are that it's some structured note / derivative transaction that made it possible for you to get a mortgage on your house or your car loan. Well, even if you have never gone to a bank and dealt with them in any meaningful way shape or form, let alone have taken out some form of credit you are on a daily basis consuming the benefits of some derivative transaction somewhere. If you pay everything in solid gold in full and upfront you still use them. If you don't use them yourself, then those you buy stuff from do. That car factory that the car you didn't finance (good for you) comes from got funded using some crazily complicated swap structure. If they hadn't done that, you'd be paying more for that car. IF you could afford it at all. Or that mortgage, for that matter. I bet you, our friends at the G20 didn't think a whole lot about that when they declared war on derivatives and set the regulatory freight train coming our way in motion. Now, the point of this is not to tell you all that derivatives are a godsend. Rather I want to illustrate how trying to regulate the outcome of a market will very quickly generate some previously undreamed of externality that will ruin your day. I'm not going to claim knowledge of any particular outcome of this upcoming set of regulations in the derivatives markets, but what is clear to me is that without a much better understanding of what markets are by those who set the rules we're certainly not going to get the best possible use of markets at all. Understanding that the invisible hand is in the first instance INVISIBLE and has a reach that probably exceeds of most of our imagination (and certainly our predictive powers) is quintessential if we want anything other than unintended consequences to come from our attempts at controlling market places. The trick is to decide in which instance to unleash a market on a problem, not how to reign it in! It looks to me like going back to basics might be helpful here. So I told my grad to goddamn better read some Adam Smith. Wish I could tell that to the talking heads on TV irritating me on a regular basis as well. Rant over.

Labels: Pay, Rockstars, Banksters, Incredulity

Incredulity

Sunday, 1 May 2011

Rockstars and Banksters

The other day I woke up to yet another insipid debate about bankers’ excessive pay on Radio 4 (yes, I do listen to the radio station of the aspirational middle class - get over it!). What struck me is that this by now seemingly endless debate (if you can call it that) no longer really relates to the altogether justifiable outcry over excessive pay for bankers whose institutions were saved by the taxpayer’s purse in times of financial stress. Instead, we seem to have moved on to a new type of complaint: The bankers simply earn too much money! It no longer seems to matter that, say Bob Diamond, CEO of Barclays bank never took his shop cap in hand to the treasury when the going got tough, but instead found private funds to shore up his bank. The gripe is now simply about him earning loads of money. And to be fair, it is a chunky bit of dosh coming his way. What isn’t so clear to me is why he (and his cohort of fellow bankers) is in the spotlight for this. It certainly isn’t the case that he earned more money than Robert Iger (who adds to humanities well being by running Walt Disney Co.). Or for that matter Jay-Z. Who I believe took home approximate six times as much as poor old Bobby Diamond last year. Now, don’t get me wrong, I’m hardly going to sing songs of lamentation for a CEO who walks home with a seven figure pay packet every year. I would, however, point at the strange blind spot that our friends at the Today program seem to have when it comes scrutinizing the pay of those not running banks these days. Why, I ask, is it okay for a reasonably foul mouthed rap-star to make a staggering amount of money by selling torrents of overproduced invectives and garish Chinese-made leisure wear but not for somebody running one of the world’s largest privately owned banks? I daresay it is not because some Rawlsian calculus of utility indicates the former to be more deserving than the latter. I reckon it is because for most people out there (be it the more degenerate rabble that features on various reality TV-programs or the somewhat terse crowd lamenting slow erosion of received pronunciation at the BBC) just cannot fathom what a banker really does. While we can all at least imagine how Bono manages to rack up his millions (and truth be told, think we probably could give it a decent try ourselves, given half a chance) public imagination seems unable to penetrate the smokescreen of nefarious plotting and dealing that no doubt fills the average banking executives Machiavellian diary. Let’s face it; most chaps out there don’t begrudge The Boss being a better singer guitarist than they ever could hope to be. At least they can understand what he does (let’s not bring Lady Gaga into this line of thinking, however). I guess it is just hard to accept that there are in fact some people out there that spend their days doing things that seem utterly tedious and quite possibly incomprehensible to most of humanity and yet get paid handsomely for it. Which is ironic, as one quick glance at the saddening sight of the average investment banker’s collection of incredibly beautiful yet woefully underused vintage guitars will immediately tell you that banks are full of failed rock stars.

The other day I woke up to yet another insipid debate about bankers’ excessive pay on Radio 4 (yes, I do listen to the radio station of the aspirational middle class - get over it!). What struck me is that this by now seemingly endless debate (if you can call it that) no longer really relates to the altogether justifiable outcry over excessive pay for bankers whose institutions were saved by the taxpayer’s purse in times of financial stress. Instead, we seem to have moved on to a new type of complaint: The bankers simply earn too much money! It no longer seems to matter that, say Bob Diamond, CEO of Barclays bank never took his shop cap in hand to the treasury when the going got tough, but instead found private funds to shore up his bank. The gripe is now simply about him earning loads of money. And to be fair, it is a chunky bit of dosh coming his way. What isn’t so clear to me is why he (and his cohort of fellow bankers) is in the spotlight for this. It certainly isn’t the case that he earned more money than Robert Iger (who adds to humanities well being by running Walt Disney Co.). Or for that matter Jay-Z. Who I believe took home approximate six times as much as poor old Bobby Diamond last year. Now, don’t get me wrong, I’m hardly going to sing songs of lamentation for a CEO who walks home with a seven figure pay packet every year. I would, however, point at the strange blind spot that our friends at the Today program seem to have when it comes scrutinizing the pay of those not running banks these days. Why, I ask, is it okay for a reasonably foul mouthed rap-star to make a staggering amount of money by selling torrents of overproduced invectives and garish Chinese-made leisure wear but not for somebody running one of the world’s largest privately owned banks? I daresay it is not because some Rawlsian calculus of utility indicates the former to be more deserving than the latter. I reckon it is because for most people out there (be it the more degenerate rabble that features on various reality TV-programs or the somewhat terse crowd lamenting slow erosion of received pronunciation at the BBC) just cannot fathom what a banker really does. While we can all at least imagine how Bono manages to rack up his millions (and truth be told, think we probably could give it a decent try ourselves, given half a chance) public imagination seems unable to penetrate the smokescreen of nefarious plotting and dealing that no doubt fills the average banking executives Machiavellian diary. Let’s face it; most chaps out there don’t begrudge The Boss being a better singer guitarist than they ever could hope to be. At least they can understand what he does (let’s not bring Lady Gaga into this line of thinking, however). I guess it is just hard to accept that there are in fact some people out there that spend their days doing things that seem utterly tedious and quite possibly incomprehensible to most of humanity and yet get paid handsomely for it. Which is ironic, as one quick glance at the saddening sight of the average investment banker’s collection of incredibly beautiful yet woefully underused vintage guitars will immediately tell you that banks are full of failed rock stars.

Labels: Pay, Rockstars, Banksters, Incredulity

Incredulity,

Pay,

Rockstars

Subscribe to:

Comments (Atom)